Decoding the Complexities of MILITARY COMPOSITE STANDARD PAY AND REIMBURSEMENT RATES

Introduction

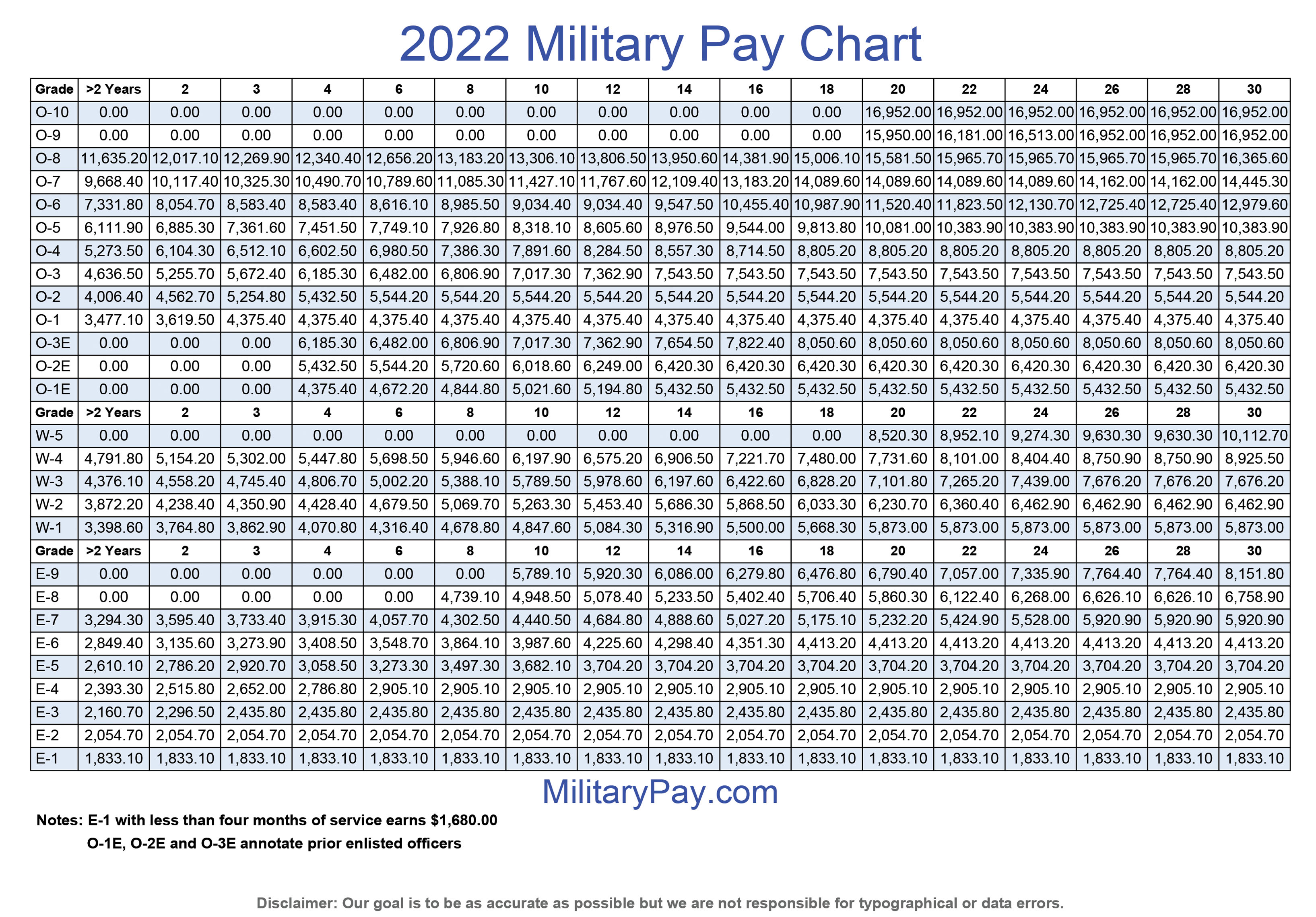

The United States military’s Composite Standard Pay and Reimbursement Rates (CSP-RR) is a complex system that determines the pay and allowances for service members. These rates are set by Congress and the Department of Defense (DoD) and are designed to ensure that military personnel are compensated fairly for their service. However, the CSP-RR system can be difficult to understand, and it is often the subject of debate.

CSP-RR Components

The CSP-RR system is composed of two main components: basic pay and allowances. Basic pay is a fixed amount that is determined by the service member’s rank and years of service. Allowances are additional payments that are intended to cover the costs of housing, food, and other expenses.

There are a wide variety of allowances available to military personnel, including:

- Basic Allowance for Housing (BAH)

- Basic Allowance for Subsistence (BAS)

- Clothing Allowance

- Family Separation Allowance

- Temporary Duty (TDY) Allowance

The amount of allowance that a service member receives is determined by their rank, paygrade, and location.

Variation by Location and Rank

The CSP-RR system is designed to ensure that military personnel are compensated fairly regardless of their location or rank. However, there can be significant variation in the amount of pay and allowances that service members receive. This is due to the fact that the cost of living can vary significantly from one location to another, and the DoD adjusts the CSP-RR rates accordingly.

For example, a service member who is stationed in a high-cost area, such as New York City, will receive a higher BAH than a service member who is stationed in a low-cost area, such as rural Alabama. Similarly, a service member who has a higher rank will receive a higher basic pay than a service member who has a lower rank.

Criticisms of the CSP-RR System

The CSP-RR system has been criticized for a number of reasons. Some critics argue that the system is too complex and that it is difficult to understand. Others argue that the system is unfair and that it does not provide adequate compensation for military personnel.

One of the most common criticisms of the CSP-RR system is that it is too reliant on allowances. Allowances are intended to cover the costs of housing, food, and other expenses, but they are not always sufficient. This can lead to financial hardship for military personnel, especially those who are stationed in high-cost areas.

Another criticism of the CSP-RR system is that it does not provide adequate compensation for military personnel who are deployed to combat zones. These service members often face additional expenses, such as the cost of body armor and other protective gear. The CSP-RR system does not always take these additional expenses into account.

Conclusion

The CSP-RR system is a complex and controversial issue. There are valid arguments to be made both for and against the system. Ultimately, it is up to Congress and the DoD to decide whether or not the system is meeting the needs of military personnel.

In the meantime, it is important for military personnel to understand the CSP-RR system and how it affects their pay and allowances. This information can help them to make informed decisions about their finances and their careers.